Predictive Analysis

We basically service the predictive services

TradeFlow: Democratizing Algorithmic Trading

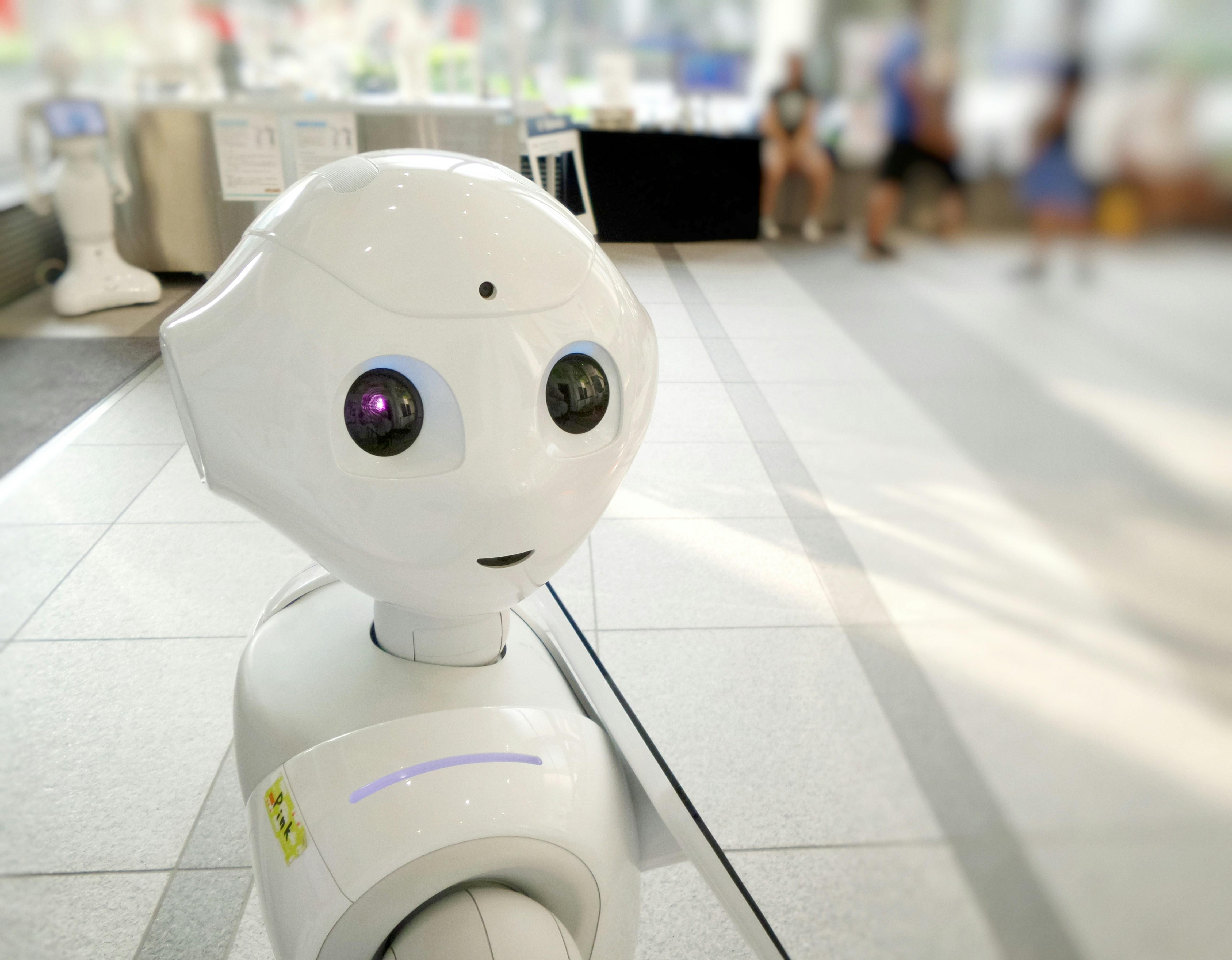

AI-Powered Computer Vision Solutions – Transforming Visual Data into Actionable Insights

Design, Deploy, Trade — All in One Platform

Our cutting-edge trading platform empowers businesses and individual traders to harness the power of algorithmic trading without complex programming or infrastructure. From strategy creation to execution and risk management, TradeFlow provides a complete ecosystem for capturing market opportunities with precision and confidence.

Strategy Designer

Transform your trading ideas into executable strategies with our intuitive visual designer:

- No-code strategy builder with drag-and-drop components for technical indicators and trading logic

- Backtesting engine that simulates your strategy against historical market data

- Performance analytics providing detailed metrics on returns, drawdowns, and risk measures

- Strategy optimization tools to fine-tune parameters for maximum effectiveness

- Template library featuring proven strategy frameworks to customize and deploy

Multi-broker Execution

Deploy your strategies across multiple brokers with seamless integration:

- Universal broker connectivity supporting major retail and institutional brokers

- Order type flexibility including market, limit, stop, and algorithmic orders

- Real-time execution monitoring with detailed transaction analysis

- Smart order routing to optimize execution quality and minimize costs

- API-based integration with existing trading infrastructure and proprietary systems

Risk Management Suite

Protect your capital with comprehensive risk analysis and hedging tools:

- Real-time portfolio risk calculator providing VaR, stress testing, and sensitivity analysis

- Automated hedging tools that dynamically adjust protection based on market conditions

- Position sizing optimization based on account size and risk tolerance

- Correlation analysis identifying hidden portfolio risks across asset classes

- Drawdown protection with automated circuit breakers and risk limits

Market Intelligence

Stay ahead of market movements with integrated analytics:

- Real-time market data across global equities, futures, options, and forex markets

- Sentiment analysis from news and social media sources

- Volatility forecasting to identify potential trading opportunities

- Economic calendar integration with automated strategy adjustment capabilities

- Custom alerts for price movements, volatility spikes, and trading opportunities

Why Choose Our Trading Platform?

- Democratized Access: Professional-grade trading technology accessible to all skill levels

- Time Efficiency: Deploy strategies in minutes instead of weeks or months

- Risk Mitigation: Comprehensive tools to protect capital during market turbulence

- Cost Effectiveness: Eliminate the need for expensive development and infrastructure

- Competitive Edge: Execute with the speed and precision previously available only to institutions

Ready to revolutionize your trading approach? Request a demo and discover how our platform can transform your trading strategy from concept to execution.